Pro du voyage & DDA : Legal travel insurance sales

Rémi

12 Jul 2023

The Insurance Distribution Directive (IDD) is a European regulation affecting travel agencies. They now have to ensure that their travel insurance meets customers’ specific needs. They are also required to provide clear information on their products and to advise their customers appropriately. Finally, they must ensure that their employees receive ongoing training on DDA. However, compliance varies from country to country.

Partner with the travel insurance experts

Start distributing legally compliant insurance products now

Before reading our recommendations concerning travel agencies, you will find in these links all the legal texts on which the DDA is based and, more generally, the obligations concerning the distribution of travel insurance, which we have used to draw up these recommendations:

Distribution is governed by this article of law: Article R211-4

Article 8 in particular, concerning the sale of travel or holidays, states:

8° Information on compulsory or optional insurance covering the cost of cancellation of the contract by the traveller or the cost of assistance,

covering repatriation in the event of accident, illness or death.

It is therefore important to understand that, at the very least, only repatriation cover should be offered to the customer at the time of contracting. We’ll see how Yupwego addresses this later.

First of all, you need to understand that the DDA is the most important document governing the distribution of insurance. Both wholesale brokers like Yupwego and distributors, be they comparators, travel agencies or even brokerage firms, are subject to this regulation. Directly or by waiver.

It incorporates a new type of distributor called theinsurance intermediary. This is the framework in which you can distribute comprehensive travel insurance, and at the very least you must distribute repatriation insurance. But with certain thresholds so as not to fall within the framework of conventional brokers.

By offering a travel insurance policy, you meet these three conditions.

If :

Then :

Otherwise :

You are a broker and subject to Orias. In the case of a travel agency, it’s best to avoid being subject to this as much as possible, in order to avoid the problems associated with brokerage and the obligations of the insurance business (registration, staff training, etc., duty to advise), and thus fall outside the scope of l’insurance intermediary

To comply with the legal framework, Yupwego offers its travel agency partners a management interface connected to its various insurers, as well as access to its brokerage platform.

Today, the platform complies with the duty to advise and the regulatory framework, both in terms of product selection and the legal documentation provided.

The travel agency acts as a distributor, and as such can offer contracts to its individual or business travelers.

It can create a contract directly on the part of the customer, as long as it records his consent on a material medium.

The travel agency’s obligation to Yupwego:

The partner has dedicated access to the yupwego.com portal. Access is via email address and password. The customer journey is then recognizable with the travel agency’s information:

Prices shown are negotiated with the partner and based on a complementary percentage of public prices.

Important: the partner can modulate the sales price based on the public price, and thus control prices according to his transformation rates.

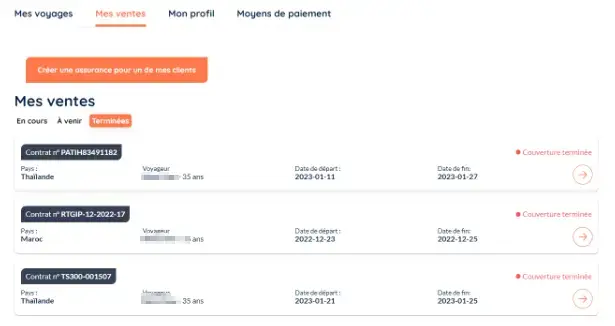

In addition to contracting as a company for its own needs, the travel agency can also create contracts for its customers.

As such, it has the option of creating a different subscriber to its account. But the overall process remains the same.

The subscriber is then automatically informed by e-mail as soon as he/she has subscribed, and of the entire process to be followed in the event of a need for assistance, via the Assistance Guide received by e-mail.

The travel agency can consult contracts via its interface and in the My sales tab:

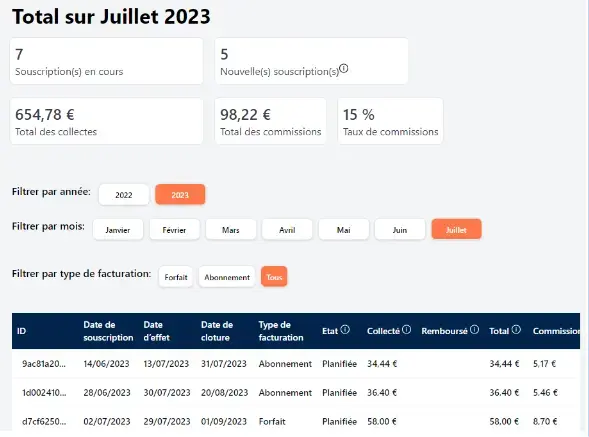

The amount of commissions can be consulted via commission reporting (version 2 of the application, currently under development, will combine the two interfaces).

Contracts are paid directly on subscription, and an invoice is issued for each payment. Invoices can be downloaded directly from the customer account.

Do you have any questions?

Our teams are here to advise you!

4,3/5 on Trustpilot

Certified partners

Human & committed service

Customized offer

Optimal coverage